In recent years, Nigeria’s fintech space has exploded with innovation, offering faster, smarter, and more user-friendly ways to handle money. At the heart of this wave is Vale Finance (@getvaleapp), a financial service fully licensed by the Central Bank of Nigeria (CBN).

Why Vale Finance Matters

For too long, many Nigerians have struggled with financial access, long queues in banking halls, hidden charges, and services that simply don’t meet the fast-paced needs of today’s digital economy. Vale Finance was created to change that narrative by putting seamless, secure, and transparent financial services directly into the hands of users.

More Than Just an App

Vale isn’t just another mobile app, it’s a licensed financial institution operating with the trust and oversight of the CBN. That license sets it apart, giving users confidence that their money is safe, transactions are regulated, and services meet national financial standards.

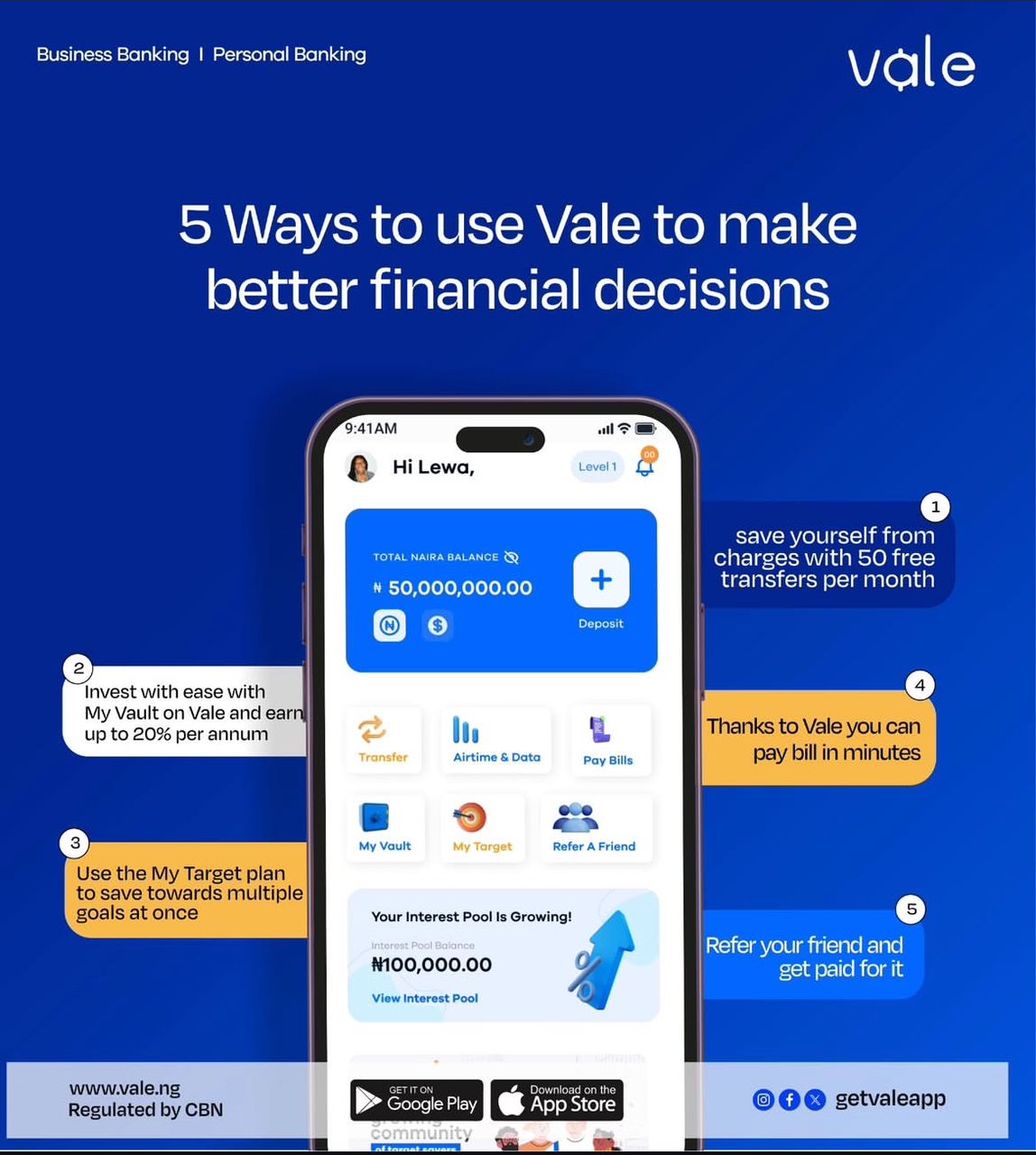

With Vale, users can:

Send and receive money instantly – no delays, no hassles.

Pay bills and utilities – all from the app in seconds.

Access financial tools – designed to simplify money management.

Back to School Made Easy

As a parent or guardian, you’ve probably done the rushed back-to-school shopping spree, last-minute expenses, endless lists, and the pressure to get it all done at once. This time, you can do things differently.

With Vale’s Back to School Challenge, you can start saving early and enjoy:

13% interest per annum on your savings

An extra 5% bonus on the interest earned

A chance to win N250,000 worth of school items

With @getvaleapp, the future of finance is already here, accessible, secure, and built for Nigerians.

Startups

Martha Odutola6 months Ago1 Mins read129

Martha Odutola6 months Ago1 Mins read129

Vale Finance: Redefining Financial Services in Nigeria

Share

Recent Posts

- Paga Partners With PayPal to Enable Account Linking for Nigerians

- Andela Strengthens AI Engineer Assessments Through Woven Acquisition

- Top Mistakes Startups Make in the First Year

- NITDA, U.S. deepen partnership to advance data privacy, AI, and cybersecurity initiatives

- How to Successfully Pitch Your SaaS Idea

Recent Comments

No comments to show.

Related Articles

Startups

Top Mistakes Startups Make in the First Year

Written by Peace Sandy The first year is often the toughest for most...

ByPeace Sandy3 weeks Ago

Startups

How to Successfully Pitch Your SaaS Idea

Written by Peace Sandy Great SaaS ideas are everywhere, but only a few...

ByPeace Sandy4 weeks Ago

Startups

How to Launch a Business Without Any Money in 2026

Written by Peace Sandy As the new year begins, many people are eager...

ByPeace Sandy1 month Ago

Startups

How Founders Can Thoughtfully Allocate Startup Equity

Written by Peace Sandy Having a co-founder can significantly strengthen a startup. Working...

ByPeace Sandy2 months Ago

Leave a comment