If you think African founders are slowing down, you are reading old news. The new generation of founders are moving smarter, not louder.

Even with global capital flows tightening, African startups still managed to raise over 1.42 billion US dollars in the first half of 2025 according to TechCabal’s State of Tech in Africa report. African startups continue to show resilience in a changing financial landscape.

Investors have become more selective. They no longer spray and pray. They now back traction, strong local relevance, and founders who execute with clarity. Here are five startups that crossed the 500 K dollar mark this year and what their journey teaches every ambitious builder on the continent.

Lengo AI – Kenya

Democratising voice recognition for African languages

Lengo AI builds voice recognition models that understand African accents and dialects. Its API powers banks, call centres, and mobile apps across East Africa.

The rise of African startups is reshaping the economic landscape, proving that innovation thrives even amid challenges.

In early 2025, the company raised about 700 K dollars in seed funding from Founders Factory Africa and Savannah Fund. Their secret weapon was context. They trained their models using real African data, collected from both rural and urban speakers, instead of relying on imported English datasets.

Founder lesson: Build for context, not clout. Technology that speaks the people’s language always wins investor trust.

Kapu – Nigeria

The social commerce comeback

After shutting operations briefly in 2023, Kapu re-emerged in 2025 with a sharper strategy. They pivoted from traditional e-commerce to community group buying powered by WhatsApp automation.

This shift reflects a broader trend among African startups seeking sustainable growth.

That shift earned them one million dollars in bridge funding from investors such as First Check Africa. Their biggest move was simplifying logistics through local delivery partners and micro-agents.

Founder lesson: Pivots are not failure. They are evolution. Be honest about what changed and show the data behind your decision. Investors value transparency when it comes with proof.

HealthTracka – Nigeria

Home diagnostics that scale like software

HealthTracka raised 600 K dollars in pre-Series A funding to expand its home lab testing service. Instead of building expensive labs, the company partners with diagnostic centres and focuses on the customer experience.

A user books a test, a nurse visits their home, and results appear on their phone. It is healthcare made simple and digital.

Founder lesson: Investors love models that grow without heavy infrastructure. Focus on distribution, not ownership.

Chari – Morocco

Digitising Africa’s informal retailers

Chari serves small retailers by providing an app for ordering inventory and accessing micro-credit. The startup raised 1.5 million dollars in 2025 through a SAFE extension after acquiring fintech company Kenz.

African startups like Chari are redefining traditional retail dynamics.

Their edge is data. By combining inventory movement with credit scoring, they turned retail distribution into a lending machine.

Founder lesson: When you connect two major pain points, logistics and finance, you build an ecosystem investors cannot ignore.

Zuri Health – Kenya and Ghana

Healthcare access through SMS and WhatsApp

Zuri Health raised 550 K dollars to expand its telemedicine service for low-income and rural users. Their solution uses SMS, WhatsApp, and USSD codes to connect patients with doctors and pharmacies.

The success of African startups highlights the importance of accessibility in healthcare.

They did not chase complexity or buzzwords. They focused on accessibility.

Founder lesson: Simplicity sells. Investors back solutions that reach more people with less internet.

What These Founders Got Right

-

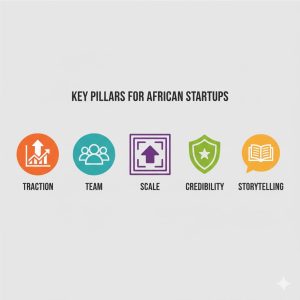

- Local relevance matters most. They solved real African problems with regional understanding.

These lessons are invaluable for upcoming African startups.

-

- Proof beats pitch. Every one of them had users, revenue, or traction before seeking big money.

- Scale smart. Growth was planned, not guessed.

- Credibility pays. Backing from accelerators or strategic partners gave them leverage.

- Storytelling converts. Numbers attract, but stories close.

The journey of these African startups shows how storytelling can bridge gaps.

Mistakes They Avoided

They did not chase vanity metrics.

They did not overspend before product-market fit.

They did not ignore regulation.

They did not copy Silicon Valley models blindly.

They stayed grounded, efficient, and focused on sustainability.

The Bottom Line

The evolution of these African startups serves as a blueprint for future ventures.

Capital is not a miracle. It is a reward for clarity and proof. These startups did not wait for investors to believe in them. They built results that made belief inevitable.

If you are building today, focus on making your success non-negotiable. Investors no longer fund ideas. They fund inevitability.

The trajectory of African startups emphasizes the need for strategic planning.

Would you like your startup to be featured next on HelloTech?

👉 Submit your story

Join the wave of African startups making a difference.